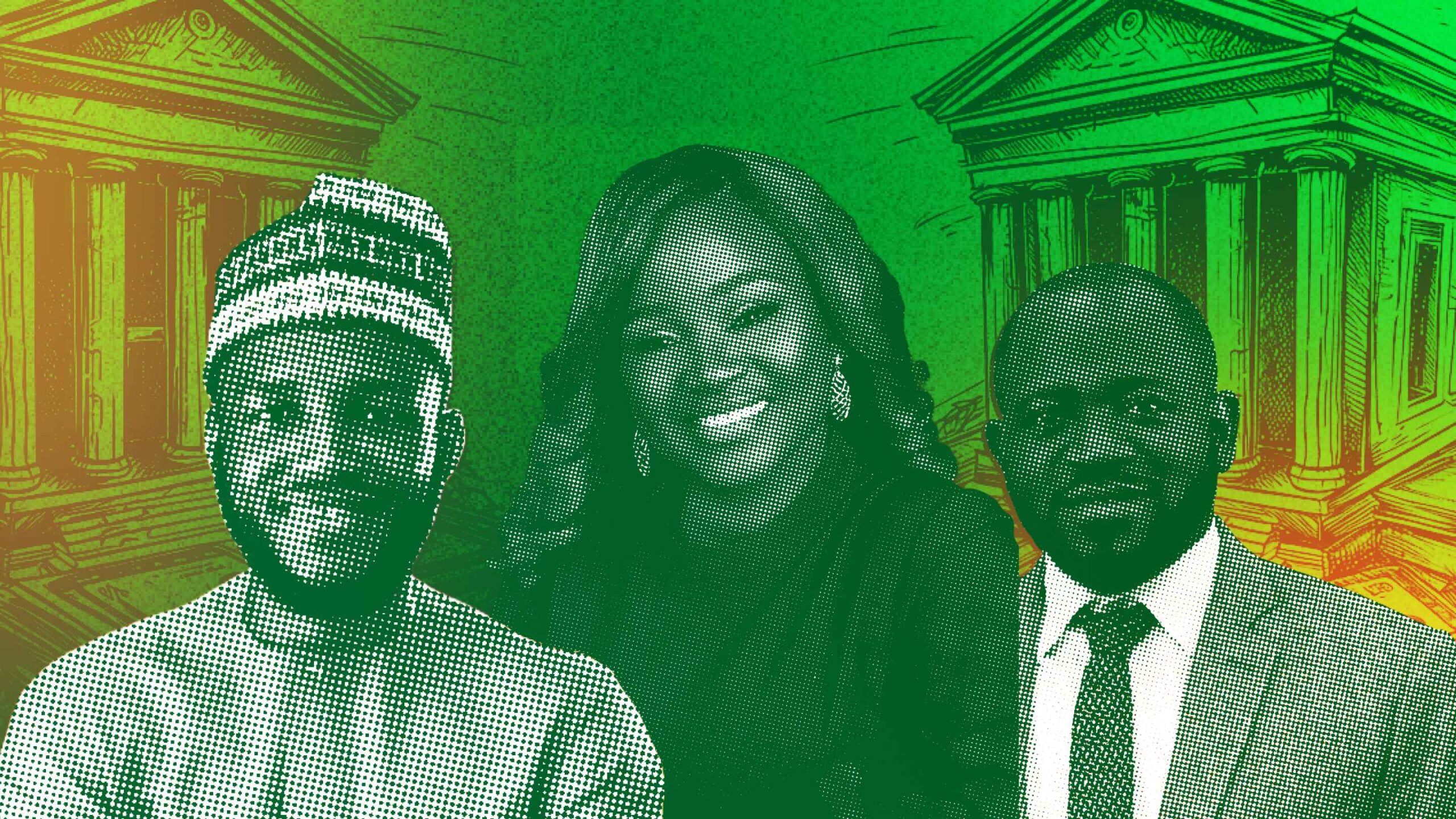

Inside Sycamore’s ambition to become a financial powerhouse

Bendada.com | Daniel Adeyemi - Mar 24, 2025

Featured entitiesThe most prominent entities mentioned in the article. Tap each entity to learn more.

AI OverviewThe most relavant information from the article.

- Sycamore disbursed over ₦40 billion ($27 million) in loans to over 300,000 users in six years.

- The co-founders faced bizarre collateral demands from potential lenders during their initial pitch.

- Sycamore launched its asset management arm, SIML, with over ₦10 billion in assets under management.

CommentaryExperimental. Chat GPT's thoughts on the subject.

The evolution of Sycamore from a peer-to-peer lending platform to a comprehensive financial services provider highlights the potential for innovation in Nigeria's financial sector. Their strategic move into asset management reflects a keen understanding of market demands and positions them well against established competitors. However, the success of this venture will depend on their ability to effectively differentiate their offerings and maintain customer trust.

SummaryA summary of the article.

Also readRecommended reading related to this content.

Newsletter

Sign up for the Newsletter

Discussion

Have a question related to Africa Tech?

Leverage the Hadu community to get answers and advice for your most pressing questions about Africa Tech.